“Sustainability is at the heart of ofi. The IIS gives finance and business teams the needed numerical link between actions on the ground, as well as their impact and dependency on the Capitals. This will help in both improving the understanding of the Capitals and in taking necessary steps towards increasing the long-term value for the company.”

Taking the initiative forward

F4S will uncover hidden costs and benefits not previously reported, support the leveraging of sustainable financing to address the most pressing supply chain sustainability issues and help support the business to “be the change for good food and a healthy future”. Our vision is to be a best-in-class business partner, responsible for maximizing long-term intrinsic value for all our stakeholders using non-financial drivers of value.

In 2021, we performed a monetary valuation of material natural capital (NC) impacts and dependencies by assigning an approximate monetary impact value. The outcomes are illustrated in our NC Profit and Loss statement (NC P&L) and NC Balance Sheet (NCBS) under the IIS.

F4S will internalize externalities via ourproduct platforms, supporting strategic financial business decisions and influencing significant stakeholders, bringing finance and sustainability concepts together.

With no formal framework for measuring these capitals, we needed a better way to measure, quantify and report our long-term “invisible” value. F4S will create partnerships and collaborations to grow this mindset.

We use a common numerical language – where applicable – that everyone can understand, evaluate and articulate. IIS allows ofi to explain the impact of our actions on the ground to all internal and external stakeholders.

F4S in the News

At ofi, we believe our finance teams are well-positioned to help businesses embed sustainability issues into a company’s risk and performance management. Our work aims to re-imagine the valuation approach and integrate the positions of key non-financial capitals in our business decisions. Find out more on how we are driving conversations across different platforms and sharing more about our work.

FAQs

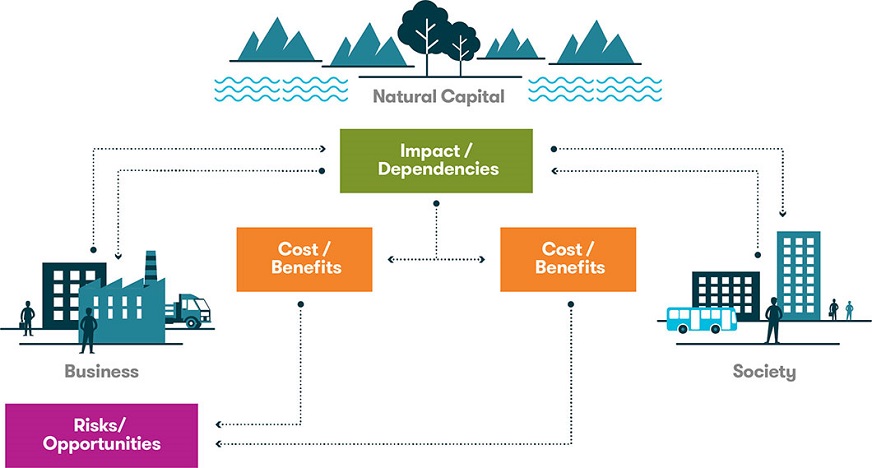

The Capitals drive Long-Term Value and underpin a significant portion of a company’s market value. The Integrated Impact Statement (IIS) is a decision-making tool, which allows ofi to manage Long-Term Value. This tool will help embed sustainability concepts – such as multi-capital accounting – into the heart of our business, through finance.

The IIS tool is made up of 3 elements: Profit and Loss; Balance Sheet; and Risk and Opportunity Statement; and covers three Capitals;

Natural Capital: The land, water, biodiversity and other ecosystem services required for food, feed and fibre production. This includes the accounting for renewable and non-renewable environmental resources which ofi depends on for its long-term sustainable operations and associated externalities.

Social Capital: The relationships we forge and nurture for long-term commercial success. This includes the accounting for external stakeholders in society – community, institutions and ofi’s contributions to those relationships through its community-based programmes.

Human Capital: The talent, skills, dedication and inspiration of our workforce and management, and our responsibilities towards them. This includes the accounting for all internal stakeholders, our workforce and management – which ofi relies upon and contributes to, through training and capacity building – and safe and healthy workplaces where rights are respected.

Like a control tower, the IIS decision-making tool effectively reports and allows ofi to manage long-term value.

The IIS leverages existing frameworks by Accounting for Sustainability, the Capitals Coalition and The Economics of Ecosystems and Biodiversity for Agriculture and Food (TEEBAgriFood).

Source of framework: Capitals Coalition (https://capitalscoalition.org/)

F4S in 2019 developed the IIS for the Cocoa business. A summary of some insights from Cocoa’s IIS on key aspects of Natural Capital is presented in Olam’s Annual Report 2019.

The insights from IIS can positively change and differentiate the way we operate and with whom we operate. We are now better informed about our Natural, Social and Human Capital impact, and can provide actionable management information to enable our Business Units to better understand their key impact areas (by Farmer Group level, by country, by commodity), and devise more appropriate plans. This way ofi endeavours to become a resilient and more reliant partner for all our stakeholders by ensuring the creation of Long-Term Value.

The IIS Natural Capital valuation scope is detailed in the table below.

Indicator | Valuation Scope | Main Data | Valuation | Cost / | ||

Country | Watershed | Biome | ||||

Land Use |

|

| Y | Farmed | Gain in biome specific benefits (Ecosystem | Benefit |

GHG | Y |

|

| Total GHG | Social cost of carbon | Cost |

GHG | Y |

|

| Carbon Sequestered | Benefit of sequestered carbon | Benefit |

Water |

| Y |

| Water | Human and ecosystem damage cost | Cost |

Water |

| Y |

| Fertiliser | Human damage cost | Cost |

Read ofi news

By Andrew Brooks, Head of Cocoa Sustainability, olam food ingredients (ofi)

This week, the world’s attention turns to a heavy burden that can damage a child’s Health and Education: child labour. In ofi's cocoa business, we are focused on solving this problem every day.

Most child labour in cocoa relates to children carrying out hazardous tasks on the family farm, distinct from the much rarer issue of forced labour, and has no one cause. Labour laws can be misunderstood, and schools might be located far away. Even if there is a school nearby, children may not have the documents they need to enrol. When combined with rural poverty, many parents think their child’s time is best spent helping on the farm. And now, these cocoa-growing communities are also battling a global health pandemic.

We’re working to tackle each of these challenges in turn. Under our Cocoa Compass sustainability ambition, we aim to completely eradicate child labour from our direct supply chain by 2030 and ensure farmers’ children can access the education they are entitled to. In 2020, we reached the critical milestone of rolling out child labour monitoring across 183,000 households in nine countries.

There is still a lot to do, and collaboration with our customers, national governments, and civil society is essential. For example, we recently asked the Fair Labor Association (FLA) to assess the extent to which cocoa farmers and their families have benefited from our sustainability programmes in Côte d’Ivoire, their perception and satisfaction with these interventions, and help to refine our approach further.

Using a due diligence methodology called Social Impact Assessment, the FLA collected extensive data and interviewed over 450 people from ten cocoa communities, including women and children. It found that of all our efforts to tackle child labour, the setting up of child labour monitoring and remediation and enabling access to education are the most advanced and have the most significant impact.

It also revealed that over two-thirds of those interviewed think child labour is on the decline in their community, and 80% believe that the interventions by ofi and our partners are contributing to protecting children.

There are areas for improvement. The FLA suggested we provide additional support to help farmers access affordable labour. And ensure greater follow-up with Village Savings and Loans Associations to maximise their ability to promote child protection.

We know that combining our efforts through multi-stakeholder partnerships, championed by local and regional governments, and supported by international finance institutions, is the best way to create the kind of long-term systemic change needed to reach universal school attendance

and graduation for children in cocoa communities.

This World Day Against Child Labour reminds us that if we want to put children first in cocoa, we must be open to testing new approaches and adapting our efforts based on what works best. The future of a cocoa generation is at stake if we don’t.